Paying Rent Using a Credit Card Using Paytm

Kevin Shahnazari

Author5 min read

Important Note: Paytm has shut down its operations in Canada

You might be excited to know about the amazing service of Paytm. Unfortunately, Paytm shut down its service for Canada users back on January 14, 2022. The shutdown of service implies that the users in Canada can no longer top-up their Paytm wallet, schedule payments, or use services like EMT transfer, bank transfer, and Canada Post. The decision is taken as being an Indian-origin company, Paytm wants to stay focused on the home market (India) and wants to use all resources for one consumer market at current.

You can read our guide on paying rent using credit card in Canada to find alternative methods of payment!

The rest of the blog outlines the steps that were needed to be taken to pay rent with a Credit card in Canada when Paytm was still in operation:

In Canada, the reliance on credit card usage is as huge as in the rest of the world. People wish to use credit cards for most transactions to seek out the related perks and benefits, along with the freedom to pay on an accrual basis. But this freedom to pay can be denied if the person you want to pay refuses to take payment through a credit card, as happens with rental payments. Rent payment, for most, is the biggest monthly expense which is why most people want to pay it through their credit cards to earn more points and rewards. Luckily, there is a hack or an indirect way through which you can still pay the rent through a credit card even if your landlord refuses to accept credit card payments.

Sounds interesting! Isn't it?

You must be intrigued to know how that can happen. This type of indirect payment is possible by getting services from a third-party application like Paytm.

What is Paytm

Paytm is an Indian-based application that allows users in Canada to pay their bills indirectly through a credit card, including the rent. You can use this application by adding money to your Paytm wallet through your credit card or debit card and then transferring the money from your Paytm wallet to anyone you desire. The Paytm application has been serving the Canadian market since 2017 when it launched the Paytm app for Canadian users.

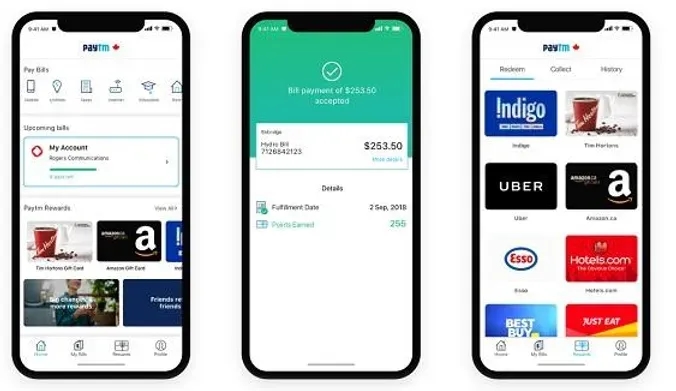

For every payment or transaction through the Paytm wallet, the users earn points that can be redeemed as a reward. The more you use Paytm, the more rewards you can earn. The cherry on top is that Paytm charges a minimal transaction fee making it a great option for users to enjoy amazing rewards.

How does Patym work?

Paytm has quite a user-friendly interface that you can operate easily. To use Paytm to transfer rent payments to the landlord, you need to take the following steps:

Step 1: Signup or login

If you are using the application for the first time, then you need to sign up by giving out your details and filling in the form. Once you have signed up for the application, you won't have to go through the extensive procedure again, and you will be able to operate the application by simply logging in. The Paytm application is available for both Android and Apple users, so you don't have to worry about the type of cell phone you are using.

Step 2: Top-up Paytm wallet by transferring money from your credit card

You need money in your Paytm wallet to transfer that money to your landlord and pay your rent. Paytm accepts Master cards, Visa cards, American Express, and bank accounts. To top-up Paytm wallet, you need to tap on the add money option, which you find at the top of the application at the center, as shown in the interface below (left).

Once you tap on the add money option, you must choose the payment method. You can choose the option to add a debit or credit card to save your credit card information (the lowest option of the right interface). You can save the credit card information here, and afterward, you simply have to tap on the saved card or schedule payments to deduct money from the credit card and transfer it to your Paytm wallet.

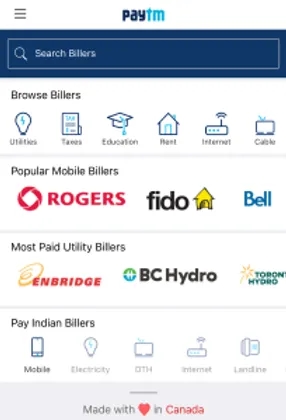

Step 3: Tap Open Rent

Once you have logged in to the application, you need to check out the options in browse billers. It will show you the most used billing options. Tap on the Rent option here or tap on the entire category to locate the rent option and tap open it.

Step 4: Select the recipient

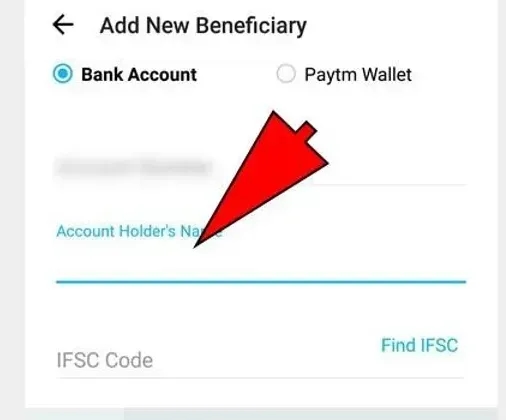

Now, you need to choose the recipient to whom you want to transfer the rent payment. To add a recipient, you can tap on the add new beneficiary option. Here you can add the bank account information or the Paytm wallet information of the recipient. If the landlord allows, you can transfer money to his/her Paytm wallet or send the money to a bank account.

Once you have added this information, you will only have to tap once on the saved beneficiary for future transactions.

After choosing the recipient, you need to enter the amount you want to transfer and tap on Proceed. Paytm charges a 1.75% fee on the total amount transferred. You will be required to confirm the transaction, after which the rent payment will be transferred to the recipient's account.

If your Paytm wallet is empty, then you will be required to select the desired credit card. Once you tap, the amount will be deducted from that credit card and will be transferred to the recipient.

Trending Offers

Scotiabank Passport® Visa Infinite* Card

BMO VIPorter World Elite Mastercard®∗

Scotia Momentum® Visa Infinite* Card

BMO VIPorter Mastercard®∗

Scotiabank Value® Visa* Card