Working hard in the background...

American Express Cobalt® Card Review

Jan 12, 2026 8:49 PM

The Bottom Line

This card was voted one of the Best Credit Card in Canada by FinlyWealth. The rewards earned on this card for a person with average spending exceed those of other credit cards in Canada by a huge margin! In addition, this card has a good benefits coverage, a flexible amex cobalt bonus points redemption program (1:1 transfer to Aeroplan® or Avios), making it the best candidate to become the main credit card for the majority of people.

Skip to: Detailed Review

Our choice for: Best travel points earning credit card in Canada

on American Express' website

Welcome Bonus

Up to 15,000 Membership Rewards® points

Annual Fee

$191.88⁕

$15.99 Paid Monthly

⁕ For Quebec, $191.88/year

Interest Rates

21.99%* / 21.99%*

RECOMMENDED CREDIT SCORE

Welcome Bonus Details

Earn 1,250 Membership Rewards® points for each monthly billing period in which you spend $750 in purchases on your amex cobalt credit card in the first Year. That's up to 15,000 Membership Rewards® points.

Card Details

Interest Rates

Purchase APR

21.99%*

Cash Advance APR

21.99%*

Fees

Annual Fee

$191.88 ($15.99 Monthly)⁕

Additional Cards

$0

⁕ Annual fee for Quebec residents is $191.88, charged yearly.

Eligibility

Minimum Individual Income

N/A

Minimum Household Income

N/A

Credit Score Estimate

Good

Type

Pros & Cons

Pros

- Impressive optimization

- 1:1 Aeroplan point transfer

- Generous welcome bonus

- Flexible high value redemptions

- Comprehensive coverage

- Highly ranked

Cons

- Limited acceptance

- Lacks valuable coverage categories

Awards

Best Travel Rewards Credit Card

2026

Our Detailed Review

If you are looking for a card that comes with great rewards and benefits, there is no need to search any longer! The American Express Cobalt card is our favorite, best overall credit card, and the best points credit card in Canada!

So what makes this card be so special? Let's find out.

The Rewards

The Amex Cobalt credit card offers one of the highest points earning rates on very popular everyday categories. Here's what you can earn and how to best use them.

How You Earn Rewards

Your points are part of the overall American Express Membership Rewards (MR) program. You can earn points as follows:

- 5 points per $1 on eligible restaurant and grocery purchases up to 12,500 points monthly

- 3 points per $1 on eligible streaming subscriptions in Canada

- 2 points per $1 on eligible gas, transit & ride share in Canada

- 1 point per $1 on all other purchases

As you can see, that's a lot of points to be earned on very common categories like food and groceries. That's usually where most people spend their money each month! The other categories people mostly spend on are ride share and gas, which are also covered by this card. Given this generous rewards program, the Amex Cobalt earns the highest rewards for the majority of people.

One restriction you have to be aware of is that there is a cap on how much you can earn in the grocery and restaurant category, which is 12,500 points, meaning $2,500 spent every month! While most people don't even get near the cap, if you are a very high spender and will frequently exceed that cap, then this card may limit your rewards, however on average you'll still come ahead with it.

Welcome Bonus

The American Express Cobalt card comes with a welcome bonus that earns you 1,250 points on every billing period if you spend over $750 in the first year. Not the biggest welcome bonus, but a very solid combination with the great rewards program of this card.

How You Redeem Rewards

American Express MR points are known for the flexibility they offer, mainly because they can be used in many different ways and are potentially worth a lot of money. In fact, they were voted the most flexible Points Program by FinlyWealth! We'll go through the most optimal redemption methods and then work our way down to the ones that are less optimal.

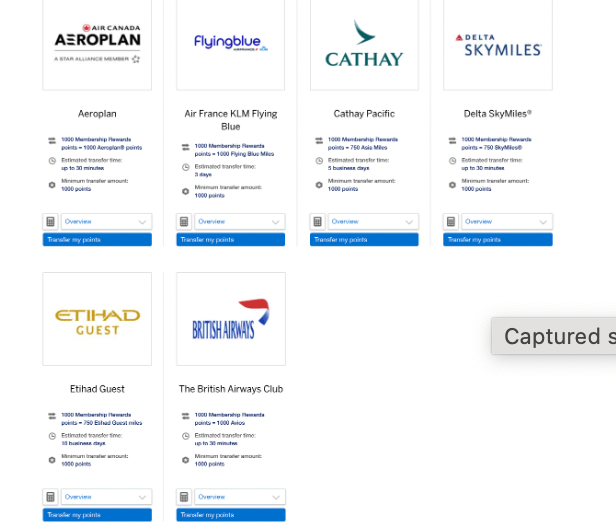

Transfer MR points to other airlines

Basically, you can convert your American Express points to these available Airline partners programs. These programs are great ways to maximize the value of your points by finding flights that don't use that many points. Many times a business or first class flight can be booked with a fraction of a price if they were being purchased with cash.

Some of the best airlines to use MR points on is Air Canada Aeroplan or Air France KLM Flying Blue. With both of these airlines, your MR points can be transferred over to the respective loyalty programs at a 1:1 ratio, with a value of 2 cents per points.

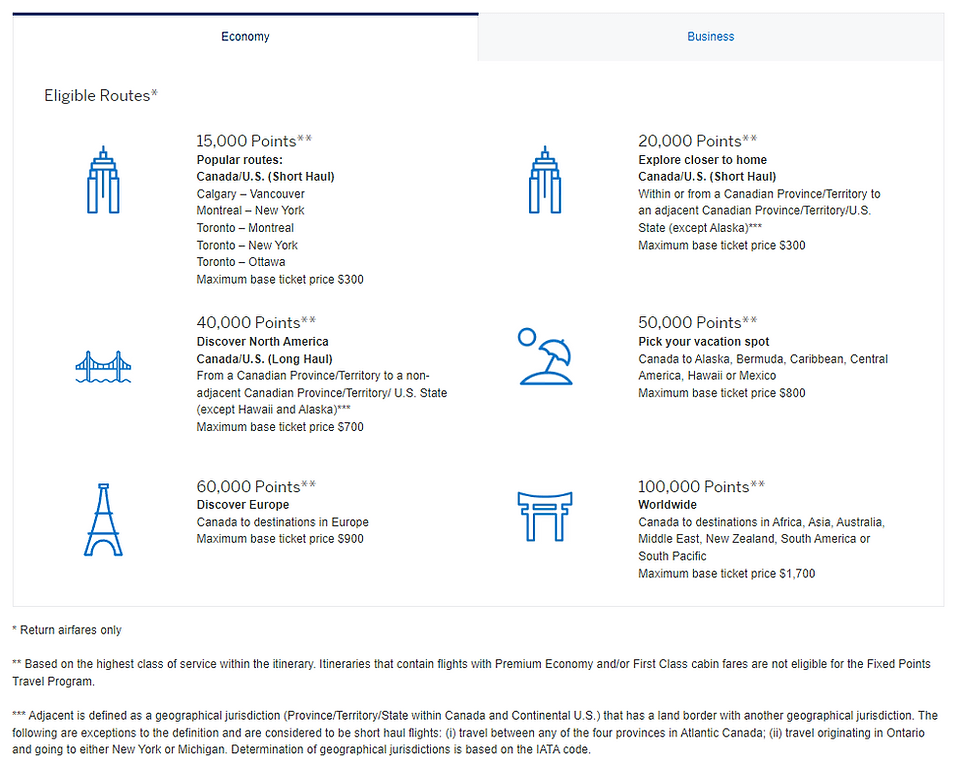

The Fixed Points Travel Program

This is the second-best option for redeeming your MR points. You essentially can redeem a fix number of your points to fly to a specific region. These points can cover the base cost of your ticket, leaving you to pay for the taxes or any other fees.

Here's a chart from the Amex website that showcases the Economy class.

A way to maximize the points is to redeem points towards certain short-haul routes. These can generally yield 2 cents per point, however, there's a limited selection that you can choose from. You can simply book a flight through the American Express Travel portal and log into your account.

Transfer MR points to hotel programs

You can Transfer your points to hotel programs to book your stay. Marriott Bonvoy is the better of the 2 since it provides more value generally, on average at about 1.1 cents per point.

Redeem MR points for any purchase

This option generally gives a lower redemption rate compared to those mentioned above. For example, if you go to your Membership Rewards page, you can get a statement credit to pay off any of your past month's purchases with your points balance. This redemption will give you 1 cent per point, which is still a considerable amount.

Redeem MR points for Gift Cards, Amazon and Merchandise

Generally these options are not recommended because they would give you an even less value than redeeming for statement credit, so it's just better to purchase one of these and then pay them off with the statement credit option.

Benefits of the American Express Cobalt Credit Card

1. Best Rewards Program in Canada

The American Express rewards program is voted the best reward program by FinlyWealth for average spenders. It offers so much in categories where most people make frequent purchases, and there is a lot of flexibility in how you can use your points at any time. Sometimes you might be travelling, and other times you might need cash, and you can redeem in different categories based on your situation.

2. Insurance Coverage

This card comes with a fantastic range of insurance coverage. From travel to mobile device insurance, you'll get more than enough coverage for most of your needs.

3. Amex Offers and Benefits

On top of the great bonus and insurance coverage, you can get in front of the line through the Front of The Line® program. Essentially this allows Amex cardholders to get early access to ticket sales on Ticketmaster. You can also get personalized Amex offers when you make purchases through certain merchants. You can usually find them on your Amex page when you're logged in. Learn more here.

4. Access to Fantastic customer service

If you ever have any issues that you want to resolve, American Express offers one of the best and fastest customer services compared to other financial institutions in Canada. Most of the time, you will be able to reach a representative in less than a minute.

Downsides of the American Express Cobalt Credit Card

1. Lower Acceptance at Merchants Across Canada

This is an unfortunate fact about Amex in general. Not all merchants are accepting of American Express in their stores at a similar level to Visa or Mastercard. Major retailers like Loblaws or Costco do not accept Amex. Additionally, there is lower acceptability compared to Mastercard and Visa when traveling abroad, especially in many European countries.

2. High Annual Fee

This card comes with a hefty monthly fee of $15.99 or $191.88 per year, which is on the higher end for cards with a mid-level annual fee.

3. Limit on the Grocery and Food category

There is a $2,500 monthly cap on the 5x points for the grocery and food categories. If you spend massive amounts in these two categories and exceed the cap, then other cards might be better suited to earning you higher rewards, however make sure to do the math first. You can use our calculator tool for the most accurate estimates.

American Express Cobalt Comparison to some reward cards

| American Express Cobalt® Card | American Express® Green Card | Scotiabank Gold American Express® Card | American Express Gold Rewards Card® | |

|---|---|---|---|---|

Welcome Bonus | Up to 15,000 Membership Rewards® points | Up to 10,000 Membership Rewards® points | Earn up to $850 in welcome offers | Earn up to 60,000 Membership Rewards® points |

Earn Rates |

|

|

|

|

Insurance Included | 10 types

| 2 types

| 13 types

| 11 types

|

Benefits | 2 benefits

| 2 benefits

| 4 benefits

| 8 benefits

|

Annual Fee | $191.88 | $0 | $120 | $250 |

Income Requirements | N/A | N/A | $12,000 personal or $12,000 household | N/A |

Apply Now | APPLY NOW | APPLY NOW | APPLY NOW | APPLY NOW |

How to Apply for the Cobalt American Express Card

To apply for the Cobalt American Express* Card, follow these steps:

- Click on the "Apply now" button on the American Express website.

- Indicate whether you are a new or returning American Express customer. If you’re an existing customer, sign in with your account; otherwise, proceed as a new applicant.

- Review the card's terms and conditions, then click "Agree and continue."

- Enter your personal information such as your name, contact details, and address.

- Provide your financial information, including your income, employment status, and any other required details.

- Upload any supporting documentation, if necessary.

- Review your application carefully, then submit it by clicking "Submit Application."

Final Verdict

Is the Amex Cobalt card really worth the $191.88 yearly fee?

The simple answer is absolutely yes. Given the amount of points you can redeem on this card, it would be hard to say no to it. This card isn't known to be the best credit card in Canada for no reason.

FAQ

Is it hard to get an Amex Cobalt Card?

Getting the Amex Cobalt card is actually one of the simplest processes compared to many other cards in Canada. It does not have an income requirement, so even many students can apply, and the estimated credit score needed for approval is a good score or above.

Does Amex Cobalt Card have a foreign transaction fee?

No foreign transaction fee is not one of the benefits provided by the American Express Cobalt. Although this card is great in almost all other aspects, it might not be the best choice for significant foreign currency purchases.

Do you have to pay Amex Cobalt in full every month?

Similar to other credit cards, you can carry a balance on your card. Although it's not recommended due to the high interest rates of credit cards, you can choose to pay only the minimum amount required by Amex and don't need to pay it in full every month.

Why is Amex Cobalt good?

It's because of having the best reward program based on our review and also being well-rounded in terms of insurance and benefits. Most other cards have one but not the other.

Does Amex Cobalt have lounge Access?

While the Amex Cobalt has many benefits, lounge access is not one of the benefits covered by this card.

About the author

Sara Skodak

Lead Writer

Since graduating from the University of Western Ontario, Sara has built a diverse writing portfolio, covering topics in the travel, business, and wellness sectors. As a self-started freelance content ...

SEE FULL BIOAbout the editor

Abid Salahi

Credit Card Expert

Abid leads the design and engineering of the FinlyWealth website, making sure everything runs smoothly and looks great. He’s a seasoned software engineer who follows best practices and designs interfa...

SEE FULL BIOWhat's on this Page

Get personalized rewards estimates — see exactly how much you could earn.

American Express Cobalt® Card Points Calculator

on American Express' website